5 Best Ways to Make Passive Income with NFTs (2023)

Did you know that you can earn passive income from your NFT collection? Discover how with this comprehensive guide.

May 19, 2023

NFTs, the game-changers of the digital realm, have taken the world by storm, reshaping how we value and monetize digital assets. NFTs have gained significant popularity due to their ability to authenticate, verify, and transfer ownership of digital assets seamlessly. Beyond art and collectibles, NFTs also hold the key to exciting opportunities for passive income.

Brace yourself as we dive into some of the ultimate secrets of earning with NFTs, unveiling the top five ways to make passive income with NFTs and the best strategies you can implement today.

What are NFTs?

In simple terms, non-fungible tokens (NFTs) are unique digital assets that represent ownership of specific content or media, ranging from artwork and music to videos or memes. What sets NFTs apart is their indivisible and non-replicable nature. Their unique characteristics have captivated the attention of countless individuals, driving them to explore opportunities for passive income through NFT ownership.

Unlike fungible tokens, NFTs possess distinct values and cannot be interchanged with one another. This has empowered artists and creators to tokenize their creations as NFTs while retaining complete ownership and control.

What are the advantages of NFTs?

While some may dismiss NFTs as a passing digital trend, they have emerged as a significant advancement with numerous benefits over traditional physical and virtual assets. Here are some advantages they offer:

-

Unique Ownership: NFTs are one-of-a-kind and can be easily verified on the blockchain, ensuring proof of ownership and eliminating the risk of fraud. Industries like luxury fashion have embraced NFTs to combat counterfeiting.

-

Access to a Global Market: NFTs can be bought and sold on NFT marketplaces worldwide, providing creators and collectors access to a vast global market.

-

Scarcity: The limited supply of NFTs makes them highly valuable and desirable to collectors, enhancing their appeal and potential for increased worth.

-

Potential for Value Appreciation: NFTs, especially those created by renowned artists or part of limited editions, can appreciate in value over time, offering investment opportunities.

-

Programmability: NFTs can be programmed with specific functionalities, such as unlocking exclusive content or granting access to special events, adding a layer of interactivity and engagement.

-

Royalties: Through smart contracts, NFTs can automatically pay royalties to the original creator whenever they are traded or resold, creating a recurring income stream for artists and content creators.

-

Versatility: NFTs can represent a wide range of digital and physical assets, including art, music, videos, virtual real estate, and more, making them adaptable to various industries.

Now that you understand the inherent advantages of NFTs, let's explore the best strategies to leverage when it comes to earning passive income with NFTs.

The 5 Best Ways to Make Passive Income from NFTs

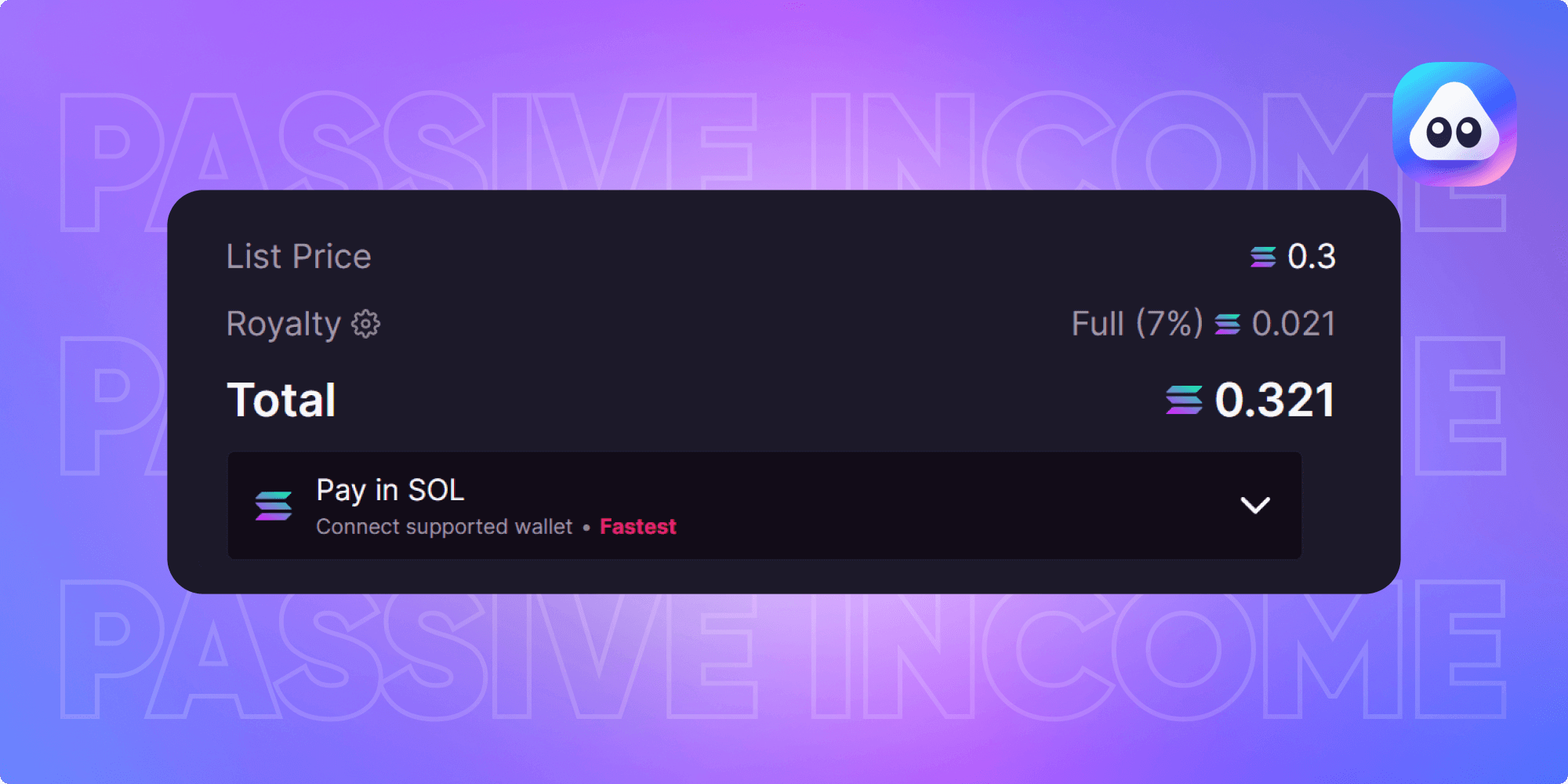

1. Earning Passive Income through NFT Royalties

As previously mentioned, NFTs offer a unique feature that allows creators to receive royalty fees each time their NFTs are resold on the secondary market. This means that creators can passively earn income by collecting royalties without active involvement in the sales process.

Royalties are automatically paid, making it a convenient and hassle-free option. Many NFT marketplaces facilitate this feature, making monetizing creators' work easy. To earn NFT royalties, you need to mint your work and set the desired royalty fees for each subsequent sale.

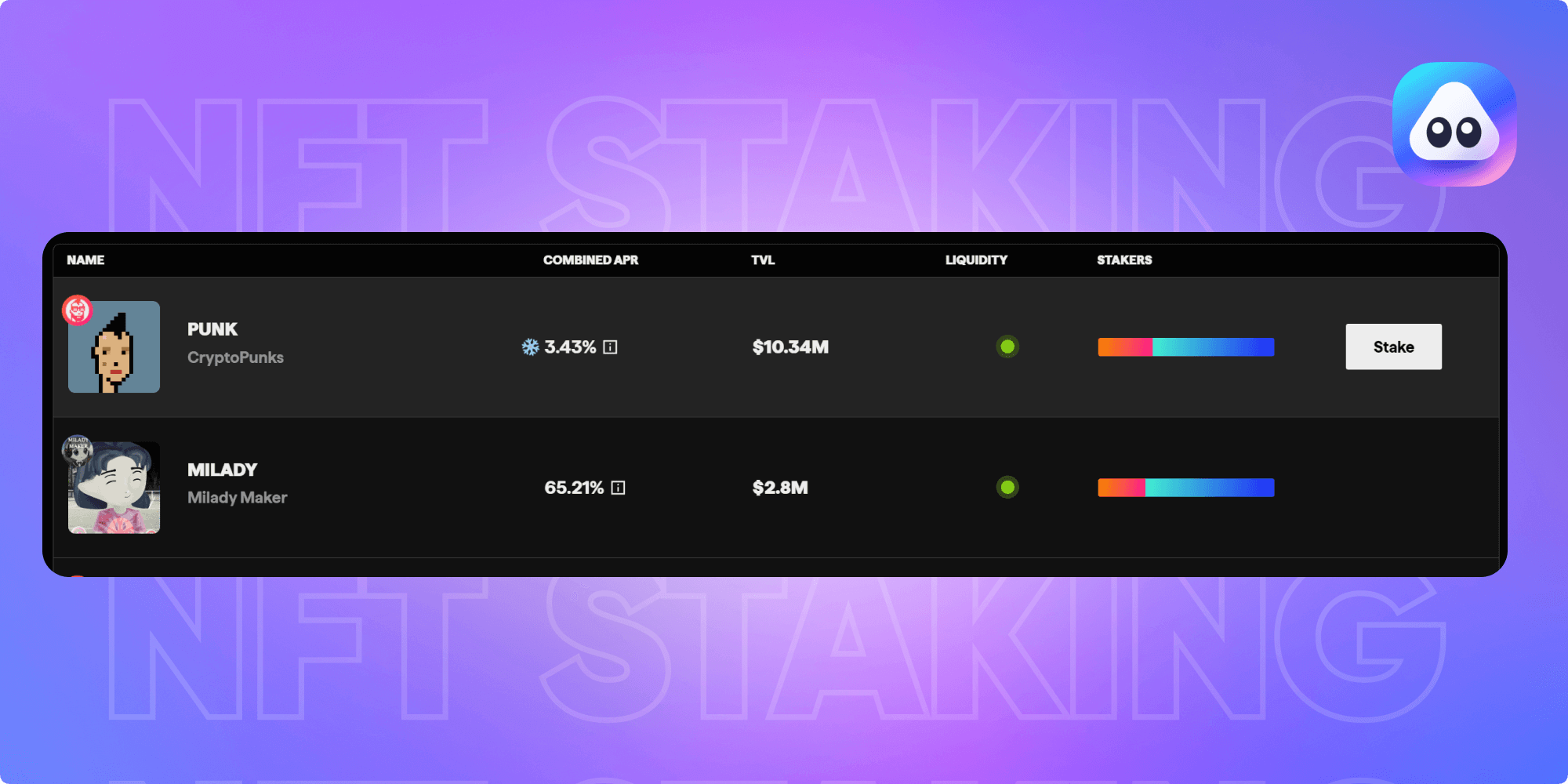

2. NFT Staking

NFT staking has emerged as a popular method for generating passive income within the cryptocurrency realm. The concept is similar to having funds in a traditional savings account and earning interest while they sit idle.

With NFT staking, users stake their non-fungible tokens in specific smart contracts that reward them with additional tokens or the original staked tokens for holding their NFTs over a predetermined staking period. Some NFT projects also allow staking in liquidity pools, enabling users to earn a portion of transaction fees generated by the platform. Liquidity pools consist of digital assets locked in smart contracts, pooled together by multiple investors, and utilized by crypto platforms for lending purposes. This passive income strategy leverages the platform's activity to generate earnings for NFT holders.

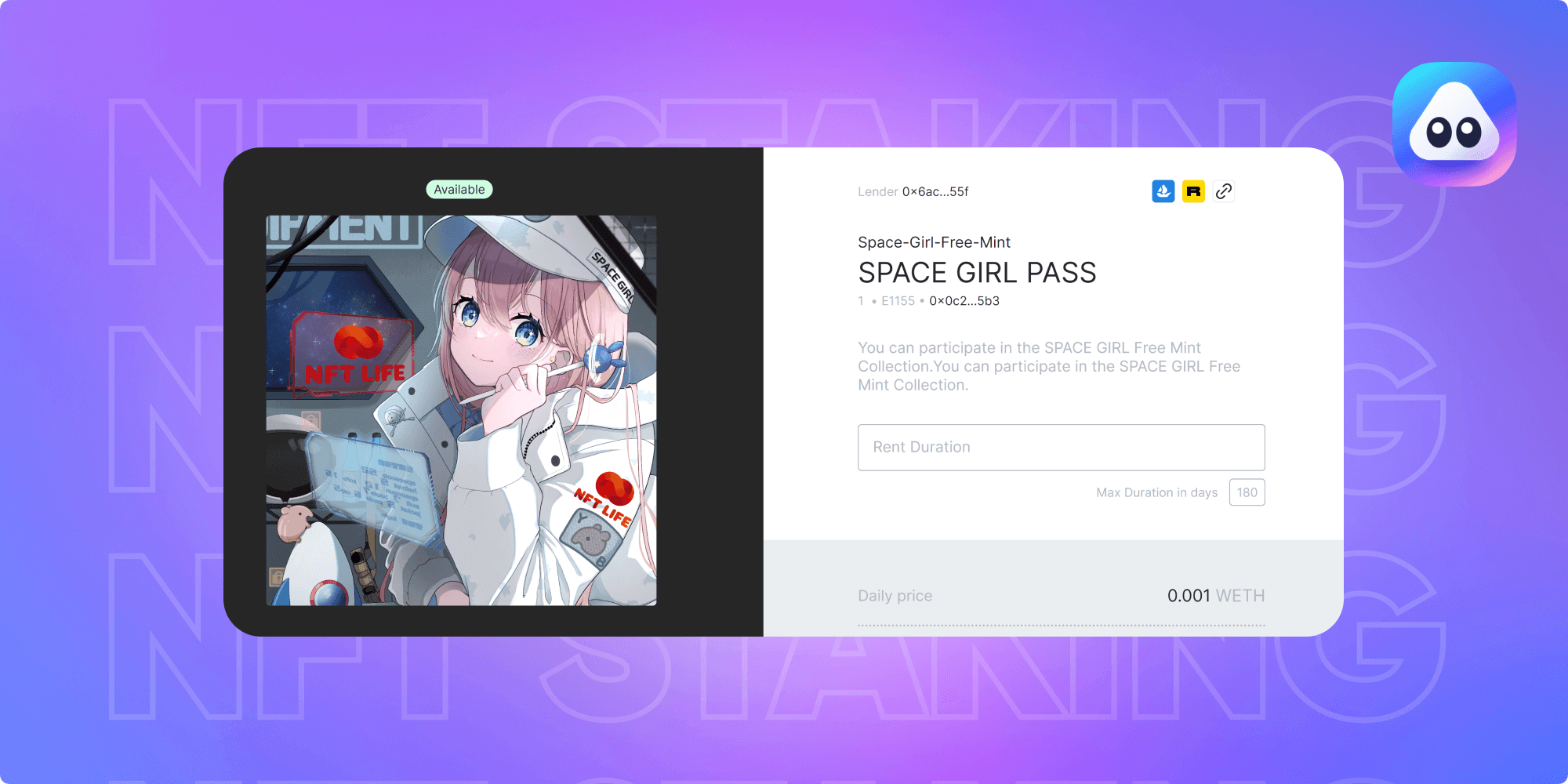

3. Generating Passive Income through NFT Renting

NFT renting enables owners to lend their digital assets to other users for a specific period in exchange for rental fees, offering a passive income stream. Analogous to renting physical properties, NFT rentals have gained traction, particularly in the metaverse and gaming industry, where virtual spaces and real estate NFTs are in high demand. Numerous NFT renting platforms, including Vera, UnitBox DAO, and reNFT, facilitate renting NFTs. The rental process typically involves the following:

- Setting a rental price.

- Specifying the rental duration.

- Outlining the terms and conditions of the agreement.

NFT owners can choose to periodically rent out their assets or invest in NFTs to rent them out for profit. Evaluating the potential demand and rental value of NFTs is crucial when pursuing this income-generating avenue.

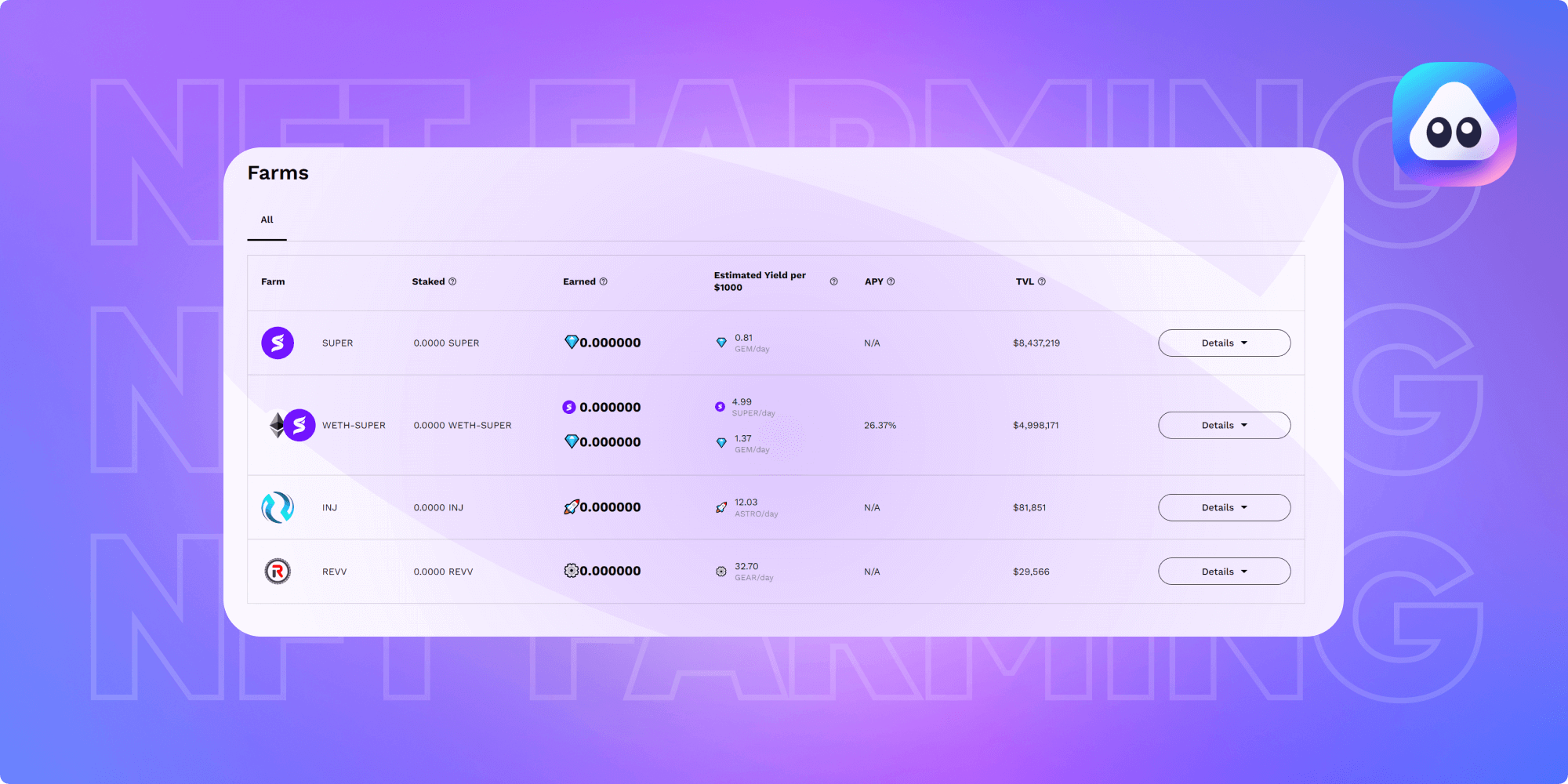

4. NFT Farming: Engaging in Active Yield Generation

NFT farming presents an alternative approach to earning passive income from NFTs, requiring more active participation than staking but offering potentially higher returns. This strategy involves providing liquidity to NFT pools within decentraized finance (DeFi) platforms. Users deposit their NFTs into liquidity pools and, in return, receive rewards such as new NFTs or the original staked tokens.

NFT farming operates similarly to yield farming in DeFi, with the distinction being the staking of NFTs to earn rewards. This approach allows users to sell the farming rewards for profit or reinvest them in other NFT or DeFi platforms. By providing liquidity to the market, NFT farming can increase the value of NFTs and support the growth of decentralized applications (dApps).

5. NFT Index Funds: Passive Diversified Investments

While not as prevalent as other strategies, some platforms offer NFT index funds, allowing investors to invest passively in diversified portfolios of NFTs. This approach provides exposure to the NFT market without the need for active management of individual NFTs.

NFT index funds function similarly to traditional index funds, tracking the performance of specific NFT indexes or market segments, such as collections of rare artwork or specific types of collectibles. To invest in an NFT index fund, individuals typically purchase shares through specialized brokers or investment platforms focusing on NFTs. These shares represent fractional ownership of the underlying NFTs held within the fund, and their value fluctuates based on NFT performance.

As with any investment, thorough research on the index fund and its NFTs and understanding the associated risks are essential. Additionally, attention should be given to investment fees to optimize potential returns.

Risks and challenges of making passive income with NFTs

As with any investment, risks, and challenges are associated with making passive income with NFTs. It's essential to be aware of these factors before diving into the NFT market:

-

Market Volatility – NFT prices can be highly volatile, with significant price fluctuations occurring within short periods. Market trends, investor sentiment, and external factors can influence the value of NFTs, so it's crucial to be prepared for potential price swings.

-

Counterfeit NFTs – The NFT market is not immune to counterfeit or fraudulent activity. Due to blockchain technology's decentralized nature, verifying the authenticity and legitimacy of NFTs before making any investment is essential.

-

Regulatory Uncertainty – The regulatory landscape surrounding NFTs is still evolving. Governments and regulatory bodies are actively exploring this emerging industry's implications and potential regulations. Stay updated with legal developments and ensure compliance with relevant regulations in your jurisdiction.

The Takeaway

Generating passive income with non-fungible tokens (NFTs) offers various strategies, and today we explored some simple and intuitive approaches to get you started. As the NFT market evolves, new opportunities will arise, allowing crypto users and newcomers to tap into the expanding digital asset economy. By staying updated on NFT developments, you can identify innovative income-generating avenues and capitalize on future rewards.

Ready to start making passive income through NFTs and DeFi? Look no further than AirNFTs! Check out this guide to learn how to begin earning today.